Lower Prices, Better Value

One of the biggest reasons buyers turn to repossessed Chinese vehicles is price. Bank-repossessed cars are already cheaper than brand-new units, and Chinese brands tend to have lower base prices to begin with. When combined, buyers can often save 20% to 40% compared to showroom prices.

This makes it possible to own a newer SUV, sedan, or crossover at the cost of an older Japanese or Korean model.

Modern Features at a Lower Cost

Chinese cars are known for being feature-packed even at entry-level pricing. Repossessed units often still include:

- Touchscreen infotainment systems

- Reverse cameras and parking sensors

- Advanced driver-assist features (depending on model)

- Digital instrument clusters and smart connectivity

Buying these features brand-new would normally require stepping up to higher-priced trims from other brands.

Relatively New and Low Mileage Units

Many repossessed Chinese cars are only one to three years old. In most cases, they are repossessed due to loan defaults, not because of mechanical problems. This means buyers may get a vehicle that is still in good running condition, sometimes even under manufacturer warranty.

Sold by Banks, Not Private Sellers

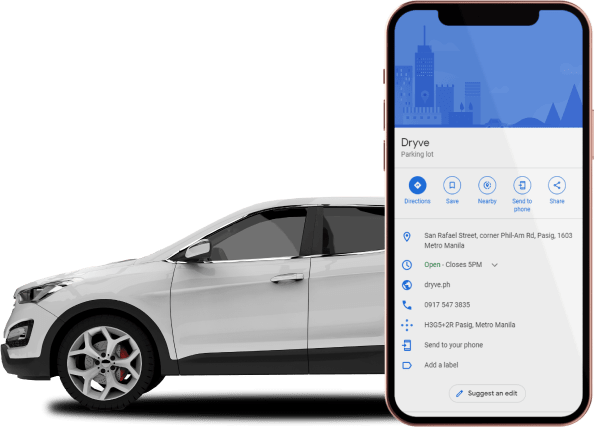

When buying a repossessed car through the Dryve.ph bidding process:

• Ownership documents are bank-verified

• The sale process is formal and transparent

• The risk of stolen or fake papers is significantly reduced

This makes bidding on Dryve.ph safer than purchasing from informal online sellers or unverified third parties, especially in a market where vehicle scams remain a concern.

Improving After-Sales Support

Chinese automakers in the Philippines have expanded dealerships and service centers nationwide. Availability of parts and trained technicians has improved significantly compared to earlier years, easing previous concerns about maintenance and repairs.

Things to Consider

While there are advantages, buyers should still be cautious:

- Repossessed cars are sold “as-is, where-is”

- Cosmetic wear or minor issues may exist

- Inspection by a trusted mechanic is strongly advised

Understanding these risks helps buyers make informed decisions and avoid surprises.

Chinese repossessed cars offer good value through lower prices and modern features. For buyers looking to bid safely, Dryve.ph provides access to bank-authorized repossessed vehicles, including Chinese car models available on the platform. This makes it easier to find affordable options and participate in a transparent bidding process with confidence.

Browse available units at www.dryve.ph or contact us through Facebook, TikTok, or Instagram @DryvePH.

Buying your first car should not be a gamble—it should be a smart investment. With Dryve PH, car ownership becomes simpler, more practical, and more affordable. It’s easy #JustDryve