Myth 1: “Buying a repossessed car is complicated.”

Many buyers assume that purchasing a repossessed unit involves a long, confusing process.

In reality: Buying a repossessed car can be straightforward when you have the right support.

At Dryve PH, we make the entire process easier by:

- Providing complete unit details upfront (mileage, appraisal value, photos, and condition)

- Guiding buyers step by step through the bidding and purchase process

- Offering transparent information so you can make confident decisions

Buying a repossessed car doesn’t have to be intimidating. With the right partner, it can be just as simple as buying any other pre-owned vehicle—only with more security and assurance.

Myth 2: “Repossessed cars are always damaged.”

A common misconception is that repossessed cars are in poor condition.

In reality: Many repossessed units are in excellent shape. They are repossessed because of unpaid loans, not because of major defects.

Many repossessed units feature:

- Low to average mileage

- Complete or verifiable maintenance records

- Good resale value potential

At Dryve PH, we make sure buyers get key information about the unit before they even visit or bid. This level of transparency helps you assess the condition and make a smart choice.

Myth 3: “It’s still better to buy brand new.”

Brand-new cars can be appealing, but they also come with higher costs—like insurance, registration, and immediate depreciation.

Repossessed cars, on the other hand, are often priced significantly lower, allowing you to get more value for your money.

Many of these units are only a few years old and still in great condition, giving you the same driving experience at a much lower price point. It’s a practical way to own a quality vehicle without overspending.

Why More Buyers Are Choosing Repossessed Cars Through Dryve PH

Buying a repossessed car isn’t just about saving money—it’s about making a smart, informed decision.

Dryve PH simplifies the process by:

- Listing repossessed units with complete, transparent details

- Providing step-by-step guidance from inquiry to turnover

- Helping buyers find the right unit based on budget, mileage preference, and needs

Whether you’re a first-time buyer or upgrading your current vehicle, repossessed cars can offer excellent value without the high costs of brand-new units.

Final Takeaway

Buying a repossessed car is not as difficult—or as risky—as many people believe. With proper guidance, transparency, and a trusted partner, it can be one of the smartest financial decisions you’ll make.

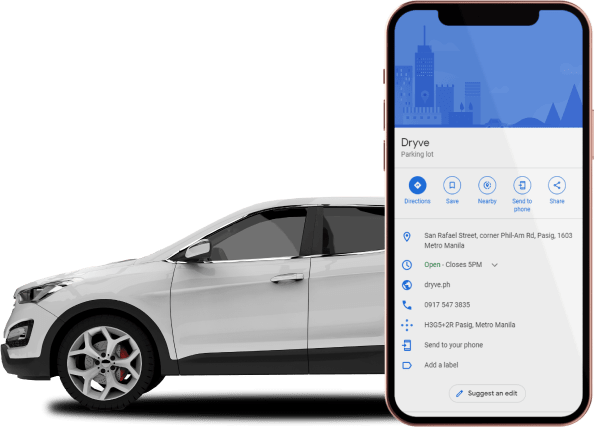

At Dryve PH, our mission is to make car ownership simpler, smarter, and more practical for every Filipino.

Browse our available units at www.dryve.ph or message us on Facebook, Instagram, or TikTok @DryvePH.

Owning a car doesn’t always have to mean buying brand new. Sometimes, the smarter move is choosing something practical.